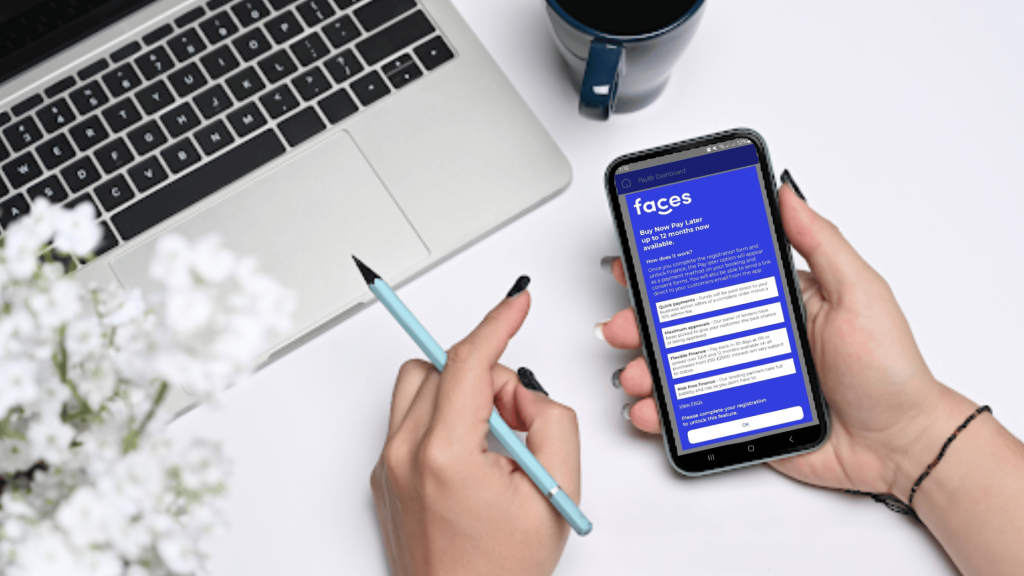

As a pillar of the aesthetics community, Faces has established itself as a resource hub for aesthetics. One key feature of Faces Buy Now Pay Later (BNPL), or Finance. From its seamless integration with our booking system to its benefits to your clinics, it’s a business booster you need!

Due to finance’s popularity with consumers, an increasing number of practitioners on Faces have registered to use this feature. There are a lot of questions surrounding this feature, and we are here to answer them! In this blog, we will cover the most common questions asked about finance. If you have any questions, please feel free to comment below!

Let’s go ahead and jump right in.

How do I promote Faces Buy Now Pay Later?

Once you get approved for this feature, there is an approved post that you can put on your social media accounts.

How can Faces Buy Now Pay Later help clinics or practitioners?

Buy Now, Pay Later empowers your clients to afford treatments by breaking down costs and increasing their willingness to choose more expensive treatments and packages.

Can I earn more from Faces Buy Now Pay Later?

Practitioners have reported a 29% increase in their sales by using the Buy Now, Pay Later feature, as their clients are more likely to book multiple treatments with this payment plan in place.

How do I get the money from my clients?

Once your client gets approved for finance, you will be paid within 24 hours after you’ve input the 4-digit PIN code, eliminating the need to chase payments.

How do practitioners or clinics sign up for Faces Buy Now Pay Later?

On your Faces dashboard, click ‘Finance Hub’ then ‘Register’. Fill out all the information, upload your documents, and sign below. Remember to click save.

What do I need to get approved for Faces Buy Now Pay Later?

To get approved, just fill out all the information needed and upload an updated insurance, training certificate, and photo ID.

I just got approved! How can I promote this?

You will receive a copy of the approved post that you can post on your social media accounts.

Is there a setup fee or a monthly fee?

No, there is no start-up cost or monthly fee. Setting up Faces Buy Now Pay Later on Faces is free.

I’ve just signed up. How long does it take to get approved?

Approval takes 24–48 business hours. If you still haven’t received a status update on your application. You can always message us through WhatsApp.

How can I offer this to my clients?

Once approved for finance, your clients can apply through the sent consent forms, your booking link, or by manually sending a link. Advertising that you offer finance is not allowed.

Conclusion

Faces’ Buy Now, Pay Later is a powerful tool that allows clients to book treatments sooner rather than later. With the troubled economy we are facing, aesthetic clinics or solo practitioners offering split payment options can increase their client base by presenting a solution to clients who don’t have disposable income right now. This act of service paves the way for strengthening client relations.

If you’re still unsure, you can always reach out to us by email, WhatsApp, or simply contact us at 01785558018.